Best Cannabis Stocks – Invest in Cannabis Stocks with 0% Fees Now!

20 min read

Groundbreaking research about marijuana and its benefits has changed the way it’s viewed in society. Now that its use is breaking into industries from medicine to beauty, companies that supply cannabis have increased in interest and taken a place within the stock market. Below, we’ll share the best cannabis stocks 2021 has to offer along with a look at where you can jump in and start your investment ventures.

What are Cannabis Stocks?

Cannabis stocks are those that deal with the production of marijuana. Now that the demand has increased, there are companies all around that have started producing, growing in revenue year after year. The cannabis industry is expected to grow, as more and more states legalize it for recreational use.

Cannabis stocks can deal with all sorts of things in the market, including the growing of crops, the equipment to do so, marijuana for medicinal purposes, or cannabis to make things like gummies and other popular items. Finding the right market is dependent on many factors, including whether or not it’s going to be legal in the area or if there are some studies that come out against the substance.

Though it seems like a stable and reliable industry, investors do need to understand how the industry works and the things that affect each company. Since marijuana plants are grown out in fields or in highly controlled greenhouses, rely on things like temperature, weather, and moisture, all of which can change over time. Before buying into the best cannabis stocks, investors should first consider the industry, understanding its ups and downs and the possibility for growth over time.

Trading vs Investing Cannabis Stocks

When considering cannabis stocks, there are two popular methods that most investors turn toward: investing and trading They are equally effective but, they work differently depending on your investing goals.

Investing in Cannabis Stocks

When you invest, you’re essentially buying a piece of a company and labeling yourself as a shareholder. As a part of the company, you have a vote in shareholder meetings and your say in the company increases with the more stock you own, making it something that you can grow with over time.

Investors looking into long-term investments will normally choose to invest, choosing a stable company and letting their money sit and grow over time. Investing in the cannabis industry is good for investing but, investors should take care when choosing a company to invest with. As a new market that’s tiptoeing around the law, drastic changes could happen that affect the market immensely.

The only thing that investors should keep a lookout for when investing is choosing the correct market. For example, looking for things that will allow you to get a share of companies who are behind the crops and other things dealing with agriculture are secure as long as they have connections that keep them in demand. On the other hand, looking for things like equipment and products used to enjoy it is another side of the market, one where investors could also come out on the profiting side.

Trading in Cannabis Stocks

Trading is a new trend that is gaining popularity with the advancement of trading technologies. Now, investors can program automated technologies to make trades for them, tracking the market and letting technology do the work for them. The changing cannabis market is a good way for traders to make money, as long as they know when to put their money in and when to take it out.

Trading comes with more risk but, the more research investors do, the better they can invest and possibly make money on their return. This is better for short-term investing and traders should have more experience and more knowledge of the market and stock overall before choosing to trade.

Unlike long-term investing, trading allows investors to take advantage of leverage. Leverage is like a loan, where traders can increase their initial investment with leverage from their broker. While this should be used with care, it’s something that could increase the amount that investors earn through trading, making it much more worthwhile.

The Best Cannabis Stocks for 2021

The cannabis market is still young and finding a stock that is both secure and profitable can be a challenge. However, as the market gets more stable and branches into more industries, there are more possibilities out there. Below, we’ve got some of the best cannabis stocks for 2021 along with a look at what you can expect from them when you invest.

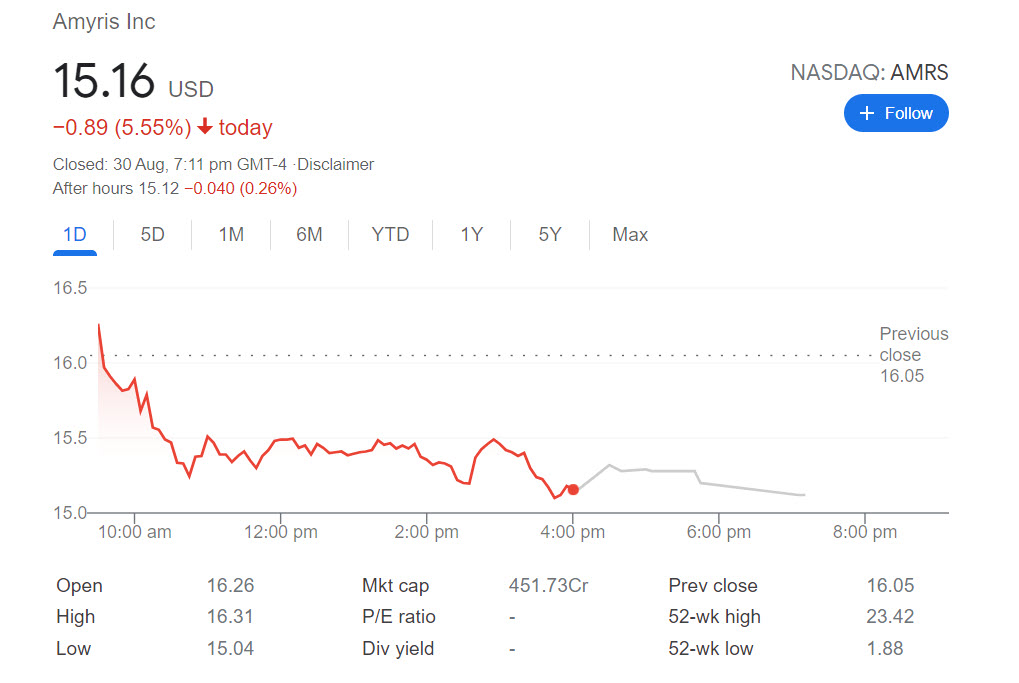

1. Amyris Inc. (AMRS)

In just one year, this stock has grown 600%. While many that were invested in them earlier are rolling in the dough, they still offer promising returns for many looking to jump in with shares priced at just $12.

They have one of the fastest-growing facilities on the market and have branched into many markets in the industry. The larger they get the more they will grow and become more stable. It could be a stock worth getting into if you’re looking for long-term growth, as they are rumored to pay out dividends soon after their most recent successes.

2. Cara Therapeutics (CARA)

Voted one of the best cannabis stocks eToro has to offer, Cara Therapeutics is one that all investors should keep an eye on. Their sales grew a whopping 2,384% over the last few quarters and they are currently at a market low for their shares (just $12 per share). The market has seen prices as high as $28 per share, something that still isn’t bad for a long-term investment.

This stock is great for both trading and investing, as there is plenty of opportunities to keep money both long and short-term. They are not paying out dividends yet but they might in the near future, especially with all of their most recent successes.

3. Cronos Group (CRON)

Cronos Group is involved in the creating of adult-use cannabis and CBD products. In an analysis of their quarter-over-quarter sales, they were up 133%, which has made many of their initial investors quite a bit of money. The hype is not over though, as the company makes profitable moves that get them more attention on a larger more global scale.

They have not only captured the attention of those looking to trade but also those who are looking to invest long-term, as they have a long list of new and improved products that are set to hit the market very soon.

4. AdvisorShares Pure US Cannabis EFT (CNBS)

For one of the best cannabis stocks ETF, CNBS is a good one to go with. The stock is considered actively managed, with those involved in the management of the mutual fund involved. There are many advantages to this kind of EFT, especially when traders can get in on it.

As of now, their sales are up over 17% YTD, which is high for a newer EFT. Still, they are on the higher side when it comes to buying in, with the expense ratio at about 0.74%.

5. Curaleaf Holdings (CURLF)

Curaleaf Holdings operates in 23 states, with dispensaries, cultivation sites, and even processing sites. Around since 2010, they have really carved a name out for themselves in the industry, creating one of the first vaporizers on the market. As of now, their market value is $9.4 billion, and shares around priced at $13.84.

Though it’s been promising for some years now (and will likely continue to be), those looking to invest should still keep a watch out and add in some stop-losses, as the company trades over the counter.

6. Grow Generation (GRWG)

As one of the best cannabis stocks Robinhood 2021, GrowGeneration is one to keep your eyes open for. They were recently named one of the biggest hydroponic garden centers in the US and since then have gone on to make a solid reputation for themselves. YTD, they’ve reported gains that are more than 12% and are thought to do bigger and better things as the market expands.

Revenue for this company hit $193 million and spiked up 143% over the last year. Though they see market highs and lows, they are a company to keep your eyes open for if you’re looking for cannabis stocks. At the moment, they are trading for $47.10 a share, which makes it a good time to jump in before they take off and start investing more heavily.

7. Tilray (TLRY)

Though Tilray is based out of British Columbia, they are a good bet for investors out of the US. They supply to two of the biggest producers in the world and have really branched out across the market over the years. Last year alone, this stock grew 62%, giving the investors that bought in early a good return.

Currently, the company has a value of $2.9 billion, an amount that investors should get excited about. Lots of promising business deals in the future plus a stable stock overall is something to look out for as the return could be substantial.

8. Silver Spike Acquisition II (SPKBU)

For investors that are looking to jump into this stock, they can do so for just $10.02 a share. They have grown a lot throughout the years, making a name for themselves for their current value of over $250 million. They saw their biggest spike back in 2019, though they continue to move along steadily.

Their long-term goal is to generate free cash flow, which they are already taking the steps to do. Investors interested in investing in something more stable can turn to this stock for something that will give them a good return and add some excitement to their trading.

9. EFTMG Alternative Harvest EFT (MJ)

These guys date all the way back to 2015 when the US first started to get involved in cannabis on a global scale. As they were the ones to pave the way for others, they hit milestones earlier, making them a safe bet for investors looking to invest in a safer stock.

Because the market in the US is expected to continue to grow along with legalization, investing in this cannabis stock is something that investors could safely do. It’s considered one of the best cannabis stocks eToro has to offer and is sure to give a return that investors were not expecting at just $21.09 per share.

10. Altria (MO)

Hear us out on this one. If you take a look at the record over the last 5 years, you will see that this stock has gotten knocked around a bit. For starters, they only say a return of 1.7% per year and haven’t had the most profitable run. Still, it’s thought that the hard times are over and the company is about to do some pretty promising things.

Shares are on the higher side ($52.31), but as the availability of cannabis increases on the market, it’s becoming something that many companies want a piece of. As the US government pushes to legalize cannabis across the US, it’s inevitable that they start to show a more positive slope, one that might be much faster than predicted.

Best Cannabis Stocks NYSE

As far as the NYSE, there are a number of cannabis stocks that experts highlight. They show potential as the market increases and as legislators start to pass laws that allow for the sale and the distribution of marijuana. If you’re looking into the NYSE, be sure to check out these top stocks.

1. Village Farms International Inc. (VFF)

When these guys announced that they would be able to increase their production by more than 50%, they caught the attention of many investors. They are based out of Canada and provide commodities in the US and other large markets, making them a company to look out for. They’ve already started to invest in more space, making them a company to keep an eye on.

2. Hydrofarm Holding Group Inc. (HYFM)

If it has to do with hydroponics, this company is where it’s at. They specialize in all of the parts and equipment needed, something that other companies don’t do to the same scale. Not only are they doing big things themselves but they have also acquired other companies and are expected to expand quite a bit in the coming years.

3. Aurora Cannabis (ACB)

Based out of Canada, this is a stock that all investors should keep their eyes on. They were recently acquired by Hydrofarm Holding Group Inc., something that is surely going to stir up their otherwise steady position in the market. They specialize in the distribution of medical marijuana, meaning that they are not likely to go anywhere if laws for recreational use change.

4. OrganiGram Holdings Inc. (OGI)

OrganiGram Holdings Inc. was hit pretty hard by the Covid-19 pandemic. They lost a lot of profits and were not able to operate under normal circumstances due to closures and other circumstances. However, now that things are starting to go back to normal, this stock is one to look out for, as it’s sure to deliver anything that investors are looking for. Though it’s not certain that it’s good as a long-term investment, it’s sure to be one that could help traders make a good amount of money short term.

5. Truelieve Cannabis Corp (TCNNF)

Though they only operate in 5 states, they’ve made a name for themselves as one of the best cannabis stocks on Cash App. They can produce large amounts and supply some of the largest demands in the US and beyond. Their recent net income of $30.1 million has put them on the map as one of the best cannabis stocks on the NYSE, which is why investors should take a look at them. They have plans to expand and are sure to start doing so very soon, which could make those who invest now more money than they might think.

How to Pick Cannabis Stocks in 2021

While looking for the best cannabis stocks under $10 is not the best and most effective way to start trading, there are a few things that traders can look for when picking the best cannabis stocks. Below, we’ll walk you through them as well as help you sift through all the stocks and find the one that’s best for you.

1. Think About your Financial Goals

Before you choose stocks, it’s a good idea to start thinking about your financial goals. When you search for a stock and choose one that works for you, it should help you reach your goals. For example, if you want a long-term investment or a short-term trading investment. Each way has a different stock that’s better for it, and answering that question first can help you decide.

2. Look at the History

The way that a stock performs is an indicator of how strong it will perform over time. Taking a look at their history is something that you should do before you put any money into the market, taking a look at how they have been performing and how they’re expected to perform over time. Many stocks were affected by the pandemic, and pointing out those that were hit the most is key to discovering the best ones for your investment goals.

3. Do your Homework

One of the key things to picking a good cannabis stock is doing your homework. Some of the key things to check include the current dealing that the business is involved in and what kinds of future endeavors they are branding into. With the cannabis industry, there is also the obvious question of whether or not there are legality issues, as the legality is such a new thing that it could impede the trading and get in the way of the goals of the company.

4. Check the Competition

One thing that most rookie investors forget to check up on is the competition. The competition is a good indicator of what a company is up against and will give a bit of insight as to the chances that the company has to get things done. When it comes to choosing individual stocks and getting into investing or trading, it’s always a good idea to check what others in the same situation are doing so that investors have a better idea of what they’re up against and also compare and contrast against their top competitor.

5. Check Debt-to-Equity Ratio

Last but not least, it’s good to check the debt-to-equity ratio. This is a good indicator of a company’s health and its ability to pull out of a rough situation. For example, if companies have a lot of debts and aren’t currently making a ton of money, they are not really going to seem strong for those looking to invest in them. Those that don’t have too much debt will prove healthier and will give investors something to look forward to in the future as their investments play out in the market.

Best Cannabis Stock Brokers in the USA

Knowing the best cannabis stocks 2021 has to offer is only the first step in starting to invest in them. Perhaps more important is choosing a broker that you can do business with. With the popularity of trading, there are a ton of brokers out there and not all of them are created equally. That’s why we’ve narrowed it down to the top three. Below, take a look at the best three out there today and get a glimpse at how they compare when we put them head-to-head.

1. eToro – Best Cannabis Broker for Beginners

eToro has made a solid name for itself for a long time now, around for decades, and giving investors of all levels a way to jump into the market and start trading fast. eToro is regulated by the FCA along with other regulators and has a long-running reputation of being one of the best brokers in the business. They don’t charge commissions for trades and offer great resources for new traders to learn the ropes.

Options for stocks are endless, as eToro has over 800 markets for traders to choose from. Markets span across several borders, including Europe, Asia, and Canada. From making long-term investments in steady stocks to trading with trending stocks, traders of all levels will have something to trade with when it comes to eToro.

When opening an account, traders only need $200 and a few minutes, able to get in and start trading in no time. Plus, downloading the eToro mobile app is a great way to stay connected and get a glimpse of what the market is doing throughout the day. For an all-inclusive easy-to-use broker with low fees and no hassle, eToro is a competitive choice.

Fees $5 cashout fee and 0.5% conversion fees Minimum Deposit As low as $200 Deposit Methods Credit or debit card, e-wallet, bank account Speed of withdrawal Typically, 3 business days Spread ranges 0.75% to 5% Leverage Options Up to 5%

Pros and Cons of eToro

Pros Cons Option to partake in copy trading Not much to offer for advanced traders Trade among more than 800 markets offered Regulated by the FCA Lots of payment options including e-wallets Comes with a downloadable app

2. AvaTrade – Best Leverage Options for Cannabis Stocks

AvaTrade has a little something to offer every level of trader. From educational resources for beginners to innovative tools for seasoned investors, you can find it all. Since 2006, AvaTrade has been in the business of connecting traders with the market, making it simple and cost-effective.

AvaTrade is compatible with trading software like MT4 and MT5, which helps traders gain more insight into market trends. Combining the two, traders can automate trades, check out trends from past months and years, and even use tracking for promising stocks.

Signing up for AvaTrade is a breeze and it takes as little as $100 to start trading. They offer great leverage and have a competitive spread that makes them stand above the market. Downloading the app and using all of the compatible software, AvaTrade offers traders of all levels the tools they need to start trading like a pro.

Fees $50/quarter for inactivity Minimum Deposit As low as $100 Deposit Methods Credit or debit card, bank transfer Speed of withdrawal As little as 3 business days Spread ranges 0.91 on average Leverage Options 1:400

Pros and Cons of AvaTrade

Pros Cons One of the best spreads on the web Inactivity fees if you don’t use after a quarter Options to integrate MT4 and MT5 technologies Option to automate trades No commissions on trades Choose from stocks, indices, and bonds

3. Capital.com – Lowest Fees for Cannabis Stocks

Capital.com has virtually no fees that traders have to worry about, which is what gets them the most attention. On top of that, they accept deposits as low as $20, one of the lowest you can find on the web.

After sign up, traders can start investing and make trades with cannabis stocks in no time. Traders have options to use educational resources or even copy trade to follow some of the most successful traders out there. There are many tools out there that are geared towards trader success, one of the top reasons why more and more traders choose capital.com.

When it comes to markets, Capital.com has plenty, though they don’t have as many as some of their competitors. Still, traders are not limited to the US and can trade in other markets such as Japan, Germany, and even Hong Kong. They offer an app for traders on the go and are compatible with other market software that helps traders analyze the market better for deeper more accurate insight.

Fees No inactivity or withdrawal fees Minimum Deposit As low as $20 Deposit Methods e-wallet, debit and credit card, bank account Speed of withdrawal 3-5 business days Spread ranges 4 pips Leverage Options 5:1 for CFDs and 30:1 for Forex

Pros and Cons of Capital.com

Pros Cons Fees are always low A bit more limited when it comes to stocks The minimum deposit starts at just $20 A library full of resources that affect the market Top-rated customer care Easy-to-use mobile app for simple trading

How to Buy Cannabis Stocks (eToro Guide)

After reading about the possibilities with the best cannabis stocks, you might be ready to start trading. Before you start to buy and trade cannabis stocks, there are a few things that you’ll need to check off of the list first. Not to panic, it’s just three steps, and we’re here to walk you through them.

Step 1: Open an Account and Upload ID

To get the process started, you’ll first have to head over to eToro and sign up. Here, you will create a password and a username. From there, you’ll receive an email to confirm, which will direct you back to the homepage.

After creating your account, you’ll need to confirm your identity. The two acceptable forms of identification include:

A passport A valid driver’s license

In addition, you will be asked for proof of address, which you can do with a utility bill or a statement from your bank account. The faster you get everything set up and verified, the faster you can get in and trade. If for any reason you don’t have a form of identification to upload, you can save that for a later date. You can still trade but you’ll be limited to $2,000.

Step 2: Deposit Funds

With eToro, the minimum deposit amount is $200. So, when your account is verified and you’re ready to start trading, you’ll have to make your first deposit. To do that, choose an accepted payment method like a credit or debit card or an e-wallet like Skrill or PayPal. Then, add any amount from $200 and up.

Step 3: Buy Cannabis Stocks

Now you’re all set and it’s time to buy. Of course, by this time you should have an idea of which stocks you’d like to purchase or keep an eye on. To find those that you’ve had your eye on, simply go to the search box at the top and type in the name. From there, you can click on the one you want, select ‘Trade’, and enter the amount you want to trade in USD.

You can check up on your trades on your dashboard or make any other moves you’d like to form the dashboard on your homepage or you can head over to the mobile app and get it done from there.

Conclusion

Cannabis is a fairly new commodity that is blowing up in certain industries. Still, there are states in the US and countries around the globe that have not yet opened up their markets to cannabis. This is expected to change but, it won’t happen any time soon, which is why it’s a good idea to do your research first.

Choosing a cannabis stock with a great return is possible, though you have some research to do. Be sure to choose a strong stock and go with a good, reliable broker to have the best experience with the best opportunity to turn a profit.

FAQs

Are cannabis stocks worth investing in?

For cannabis stocks, there are some that are worth investing in and others that are not. The thing to look for has a reliable track record and operates in a state where the laws won’t change overnight. Because the use of cannabis is tied to politics, things could change depending on the parties in the state or country where the company operates.

Before investing, it’s always a good idea to do research and doesn’t just look at trends but check out current legislation and any rulings that are up and coming surrounding the legality and use of marijuana.

There are a lot of key things that go into cannabis, some dealing with laws across borderlines of states and countries. That’s why checking on legislation and making sure everything is legal is key to investing successfully and in the manner, you were hoping to.

Are cannabis stocks secure?

Some of them are. Those that produce for medicinal purposes tend to be more secure but, not all companies do that. The volatile nature of cannabis stocks is the reason why many investors choose them for trading rather than investing, saving that for more secure long-term stocks instead.

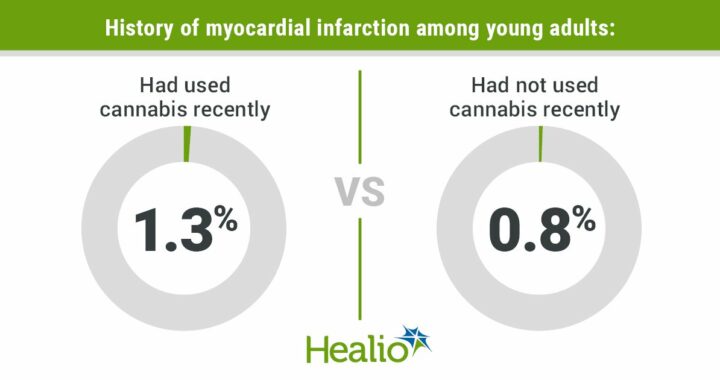

Even if a stock has a great track record, it’s recommended to first look at recent news and check out legislation in the country. Also, there could be new medical research that either supports or denies the benefits. For now, most of the research is on the positive side, though that can change if studies reveal otherwise.

What are the best cannabis stocks on Stash?

Stash is an awesome platform for investing that takes all of the hassles out. When it comes to trading with Stash, there are a number of cannabis stocks that are worth keeping your eyes peeled for, including Green Thumb Industries (GTBIF), and GrowGeneration Corp (GRWG).

Both of these are great for those looking for a steadier stock but, if you’re looking at what all the rest are doing, the most popular cannabis stock on Stash is Cronos Group (CRON), which has a market value of $4 billion. No matter which one you choose, make sure to do your research first and keep an eye on what the company is doing.

There are a lot of stocks that deal with the cannabis industry in some way, as the market exploded after recent legislation. Still, don’t fall into the hype and always do research before choosing a stock so that you have the best chances of growing your investment instead of losing it.

What is the best broker for cannabis stocks?

There are a lot of brokers out there and choosing the best one for your investing and trading goals is not always so clear. We shared three of the best, ranked by their fees, their platform, and their cannabis stocks. For a quick recap, those were eToro, AvaTrade, and Capital.com.

When searching for the best ones for you, it’s best to take a look at your goals first, finding the broker that’s closest to your needs. Finding the best one for you that offers trading with the cannabis stocks you have your eyes on is key to successfully trading with a good broker.

Apart from looking at your investment goals, it’s also a good idea to check for security, regulations, and legality of operation in your area. All of these things are key to helping choose the best cannabis stock, finding one that fits your needs and gets you closer to your goals.

Do Cannabis Stocks Pay Dividends?

Most cannabis companies are fairly new and are not yet in a position to start paying dividends. However, there are a few, especially corporate companies, that pay out dividends. Before you start trading, if you’re looking for cannabis stocks that pay out dividends, start to do some research and find them.

Then, you can look at the risk of investing with them and how often they pay out dividends. If they are in a position to pay out, they should be more stable to invest in, something that can help you rest assured before you put your money anywhere where you’re unsure.

If a cannabis company is paying out dividends, it may have an abundance of revenue for several reasons. Before jumping in and investing based on dividends, it’s good to know where those profits come from, how long they have been paid, and the probability that they will continue to be paid. All of these can give investors a better idea of where to put their money and how to use dividend stocks to their advantage.

Protected by Patchstack

Protected by Patchstack